In 1780, the War of Independence of the American Colonies from Great Britain seemed lost. The colonies and the Continental Congress had issued paper money to pay expenses of the war. The British, understanding the importance of paper money to the war, flooded the colonies with counterfeits. Their strategy worked. Colonial paper money suffered hyperinflation and became worthless. "Not worth a Continental" became idiomatic. With no money to buy supplies or to pay troops, the war seemed lost.

The Continental Congress called on Robert Morris (1734-1806) a major, probably the biggest, merchant-banker in Philadelphia to be Superintendant of Finance to use his relationships with many merchant associates to get those supplies.

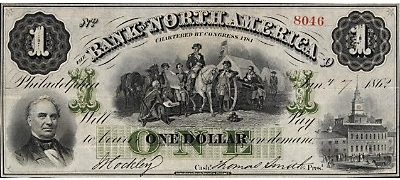

One action Robert Morris took was to establish the Bank of North America. . Its operation, following the example of the Bank of England, would be the model of money creation from that time to our own.

In letters to Benjamin Franklin, John Jay, and Robert Smith, Morris wrote:

"I mean to render this [the Bank of North America] a principal pillar of American credit, so as to obtain the money of individuals for the benefit of the Union, and thereby bind those individuals more strongly to the general cause by the ties of private interest" (Sumner, 1968b, Vol. 2:27).

Morris reasoned that "the monied interest" would support the new government because they would receive dividend income from the bank.

In his letter, Morris blamed depreciation of the currency on it being paper money. Nonetheless, subscribers would purchase bank stock with paper debt certificates and the Bank of North America would issue its loans as paper bank notes.

The Bank of North America (today part of Wells Fargo) began business in January 1782. Alexander Hamilton followed Robert Morris's example by founding the Bank of New York in 1784 (now BNY-Mellon). The Massachusetts Bank (now part of Bank of America) was founded in Boston in 1784. John Hancock signed its charter and major stockholders included Paul Revere, Samuel Adams, and Henry Knox.

The Bank of North America (today part of Wells Fargo) began business in January 1782. Alexander Hamilton followed Robert Morris's example by founding the Bank of New York in 1784 (now BNY-Mellon). The Massachusetts Bank (now part of Bank of America) was founded in Boston in 1784. John Hancock signed its charter and major stockholders included Paul Revere, Samuel Adams, and Henry Knox.

The bank originated money by issuing its paper bank notes to customers as loans to be repaid plus interest.

This note is dated 1862 long after the charter of the bank.

Shown under "The Bank of North America" are the words "Chartered by Congress 1781."

The interest would pay bank expenses plus a dividend to bank stockholders.

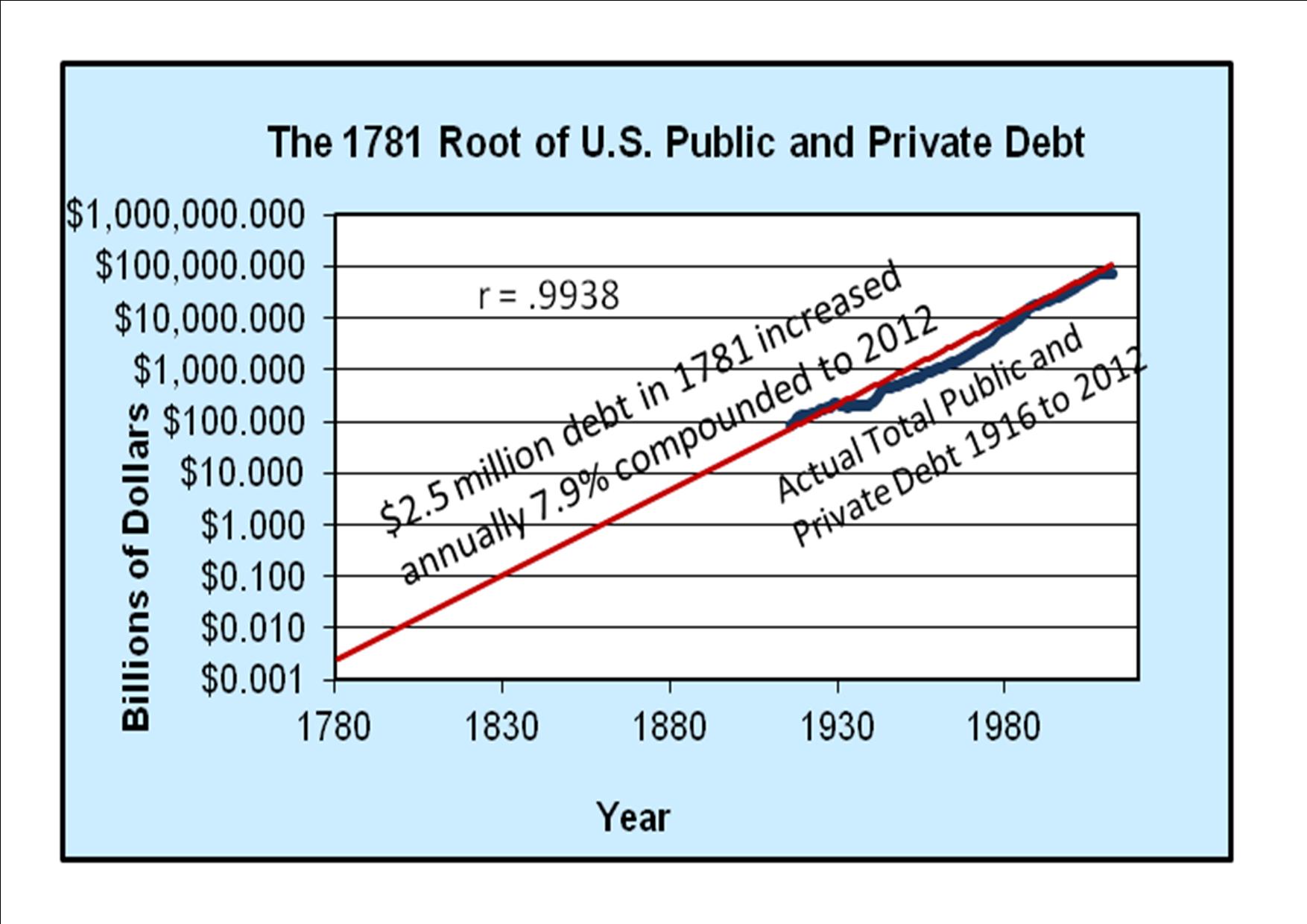

The Bank of North America started business in January 1782. What Robert Morris called "the floating debt" in 1781 was $2.536 million. Morris reported that the profit of the bank averaged 7 3/4 to 8 percent per year.

If you increase that debt, $2.536, 7.9% compounded annually, you get the red line in the graph.

The red line passes through the blue line almost perfectly, r = .9938. The blue line represents the actual total debt of the entire economy, federal, state and local governments, corporations, farm, mortgage, credit card, commercial, and financial debt.

The only two major exceptions to the very consistent annual growth in debt are the 1930 years of the General Depression and after 2007 when total debt stopped growing enough to keep up with its historical pattern. To do so now would require tens of trillions of more debt.

Imagine all the trouble that growing indebtedness has caused throughout United States history. The countless bankrupcies and foreclosures, the loss of personal savings with bank closures, the crimes caused by deprivation and desperation.

Meanwhile, on the creditor side of bank ledgers, claims to wealth grew. For their owners, life steadily improved, not by much for some, perhaps six or eight percent a year, hardly enough to cover the rising cost of living, very modest, hardly noticable. But for others, income and wealth grew beyond their wildest dreams, generation after generation. From money to spare, to money to invest, to the point that you have no idea how much you own - and you don't care. You have no need to care.

Citizens of the same country have become divided on an income scale that goes from the depths of poverty continously upward by graduated income differences to beyond the stratosphere, caused by creating money as interest-bearing debt, since 1781.

We had nothing to do with its creation, yet we are that next generation they always refer to when they imagine what will happen in the future. Well, my friends, the future is now, and it always is.

U.S. history teaches that George Washington, Benjamin Franklin, Thomas Jefferson, James Madison, and Alexander Hamilton were the most important founding fathers. But behind the scenes, Gouverneur Morris, Robert Morris and Alexander Hamilton were taking for their own the most important power of government, the power to issue money. At the time, it was called, "to emit bills."

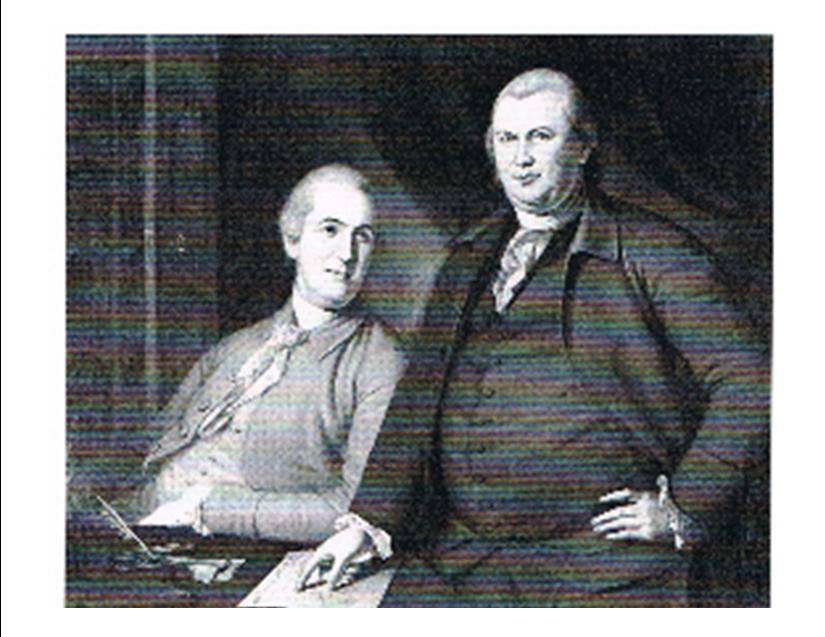

Gouverneur Morris is on the left, Robert Morris is on the right.

Gouverneur Morris was descended on his mother's side from the Dutch who governed New Amsterdam before the British took it over and renamed it, New York. ("Gouverneur" is the french word for governor. Gouverneur was his mother's maiden name.) Gouverneur was a co-founder of the Bank of North America and a delegate to the Federal Convention that drafted the Constitution. Although James Madison is called the "Father of the Constitution," a reading of Madison notes taken during that convention convinced me that Gouverneur Morris was far more influential in shaping the Constitution.

Although he chose not to attend the first month of the four and a half months of that convention,Gouverneur Morris spoke 173 times, more than any other delegate. He made the fateful motion on August 16, 1787 to deny Congress the power to issue paper money, a power it had had under the Articles of Confederation and crucial to financing the early years of the war.

As a member of the Committee of Detail charged with giving final form to the many propositions voted for in the convention, Gouverneur Morris organized them into the articles that we know as the Constitution. He actually wrote the Constitution. It is his handwriting.

For the Preamble, he replaced the enumeration of the states with the phrase "We the People." The Constitution was to make the national government superior to the state legislatures. Yet he is unknown to us. I became curious about him from reading Madison's notes. His name kept coming up and I wondered, "Who is this guy?" (Besides his roles in founding the Bank of North America and shaping the Constitution, he also laid out the streets of New York as a grid, proposed the dollar be a decimal system, and was a leader in getting the Erie Canal built. The statue of George Washington that stands in the Rotunda of the Virginia State Capitol is George Washington's head and Gouverneur Morris' body!)

Alexander Hamilton as Secretary of the Treasury and Robert Morris in the Senate made federal debt permanent with the Funding Act passed August 4, 1790 and consolidated the private control of the money supply with the Bank Act passed February 2, 1791. From then to our own day, we would think the Federal government was issuing our money, while in reality, the Federal government's role has been to enforce the payment of interest on a money supply created and owned by private banks and their shareholders.

In a letter to the Pennsylvania Gazette, January 27, 1790, "A Farmer" protesting Hamilton's plan to base the money supply on privately owned Revolutionary War debt, predicted:

"Such injustice and oppression may be coloured over with fine words, but there is a time coming when the pen of history will detect and expose the folly of the arguments in favor of the proposed system, as well as the iniquity" (Taylor, G.R., 1950, Hamilton and the National Debt. Boston: D.C. Heath: p. 53).

The word was "iniquity," not "inequity." The writer thought the system was not just unfair; it was evil.

On February 9, 1790, the first congressman from Georgia, James Jackson, warned the First Congress against passing the "Funding Act" that would make the new Federal Government responsible for paying interest on a $70 million debt. After reciting the history of Florence, Venice, Genoa, France, Spain, and England, Jackson said:

"Let us take warning by the errors of Europe, and guard against the introduction of a system followed by calamities so universal. Though our present debt be but a few millions, in the course of a single century it may be multiplied to an extent we dare not think of" (Gales & Seaton: 1131-1132).

Jackson was correct. You see the pen of history in the graph above.

Download James Jackson's speech

We need a money supply based on citizenship, not debt.

I would be happy to send you "The Root of United States Public and Private Debt Told by the Pen of History." It tells the story in more detail. As of 1987, I had traced the root of the debt problem only to 1790. I can also send you a copy of that article, "United States public and private debt: 1791 to 2000," International Social Science Journal, UNESCO, November, 1987, Paris.

Request copies by email: Bob Blain@siue.edu