Structural and Control Patterns of Depository Institutions

in Kentucky

Bin Zhou

Department of Geography

Southern Illinois University Edwardsville

Edwardsville, IL 62026

1. INTRODUCTION

Financial crisis in Asia in the late 1990s has highlighted the importance

of money in economic growth and development. The essential issue is the

amount of money available to an economy. When everything else is the same,

an economy with an ample supply of money would experience more rapid growth

than would otherwise. The amount of money available to a national economy

or the supply of money is determined by the operation of the financial

market as well as the monetary policy. Most analysts concentrate on monetary

policy as a factor in determining the money supply at the national level.

This paper deals with factors other than monetary policy, which may affect

money supply at the regional level of a domestic economy. There has been

a tradition in regional economics that examines determinants of the regional

supply of money. (7) Geographers have discussed the command and control

structure of banking. (5) In addition, both economists and geographers

have discussed issues related to banking market structure. (6, 9) This

research is set on a conceptual footing that market structure, and control

structure of the financial industry affects money supply at the regional

level. Consequently, market structure and control structure of the financial

industry act as a factor that affects economic growth and development.

Such a conceptual base requires an investigation that involve several related

issues. First, what is the market structure and command and control structure

in a regional financial market? Second, how does the market structure and

control structure of a regional financial industry affect regional money

supply? Third, how does the market structure and control structure of a

regional financial industry affect economic growth and development? As

an initial step toward study in this direction, this paper deals specifically

with the first issue, the market structure and the structure of the command

and control of a regional financial market. The study area is Kentucky.

The financial industry in this paper is defined as all depository institutions,

including commercial banks, thrifts (savings banks and savings and loan

associations) and credit unions. The reason that Kentucky is chosen as

study area is that the state contains economically drastically different

counties, such as Appalachian, rural non-Appalachian, and metropolitan

counties. This provides some "typical" examples for comparison. In addition,

the reason that the depository institutions are chosen as the focus of

study is due to the ease in obtaining information on the locations of operating

offices.

2. Money, Regional Financial Market, and Economic Growth

Mainstream economic thought in the late 20th century has seemed to arrive

at a worldwide consensus concerning the relationship between economic growth

and development on the one hand, and money on the other. Increasing the

amount of money to promote growth or tightening money supply to put a brake

on inflation has become part of regular macroeconomics policies adopted

by governments in the West and other places alike. Money mobilizes real

resources that are in idle and channels resources into further services

by functioning as rewards to resource owners. Money acts a similar mechanism

at the regional level of a domestic economy. Regional economic stagnation

or distress reflects a state of aggregate supply and demand that works

against a region. On the supply side, a region may lack the resources necessary

for a meaningful growth such as needed natural resources, physical capital

that is embodied in various economic sectors, and a labor supply of sufficient

quantity and quality. Problems within Appalachia have long been attributed

to traditional economic sectors such as agriculture, coal mining, traditional

manufacturing, etc. that have been in a long term decline since the early

20th century, to a lack of sufficient human resources such as education

and entrepreneurship, and as well as to a lack of easy access. (8) Traditional

development policies have mainly focused on the improvement of regional

supply conditions, as evidenced by highway construction, community and

education developments, etc. in various Appalachian development programs.

(2, 3)

On the demand side, lack of sufficient demand in a region may be due

to an insufficient amount of money related to low income, lack of viable

investment opportunities, etc. (2, 3) The strategy to promote tourism in

Appalachia can be seen as an effort to market the region as a profitable

investment location for new industries. Little effort has been given to

the discussion of increasing the money supply of Appalachia as a possible

strategy to enhance the aggregate demand. It may be illuminating that the

22 million people in Appalachia in 1997 was comparable to the population

of Malaysia, which achieved startling success in growth and development

prior to the 1997 financial crisis. In terms of physical size, Appalachia's

200,000-square-mile area is slightly larger than Malaysia. The success

of Malaysia in promoting growth is partly attributed to the massive inflow

of foreign capital. It is entirely conceivable that an independent country

of the size of Appalachia could achieve a rate of growth seen in Malaysia

via attracting capital from foreign lands. The reality is that the chronic

decline of Appalachia demonstrates a declining money income, which contributes

to a lack of demand.

It may well be that Appalachia's status as an integral part of the United

States has hurt its chance for growth. This is so because monetary policies

designed to stimulate regional aggregate demand would be ineffective within

a national economy where a single national currency is adopted. Under a

single currency, absence of spatial difference in exchange risk would result

in a redistribution of money from policy-target regions to unintended regions

via correspondent banking and other forms of investment. High unemployment

rates and out-migration have prevailed in many areas of Appalachia since

early this century, reflecting a region with untapped resources. It was

no help that the Federal Reserve gave up the practice whereby different

regional reserve banks set interest rates according to the regional financial

conditions. In reality, regions in slow growth may well need some extra

amount of money to mobilize their resources, and regions with an overheated

economy may well need a brake on their inflation. A uniform interest rate

across the country set by the central bank would provide money with the

same credit terms and may not fit various regional conditions. The result

is to weaken the role of monetary policy as a viable tool in promoting

regional growth.

Since it is unlikely that there would be an Appalachia oriented monetary

policy, the monetary policy as an option in promoting regional growth seems

out of the question. However, there are other factors that also affect

the amount of money potentially available to a region. One of these factors

is the financial market structure. The theory of the regional financial

market (1, 4) suggests that there exists a spectrum of regional segmentation

of financial markets, ranging from perfect financial capital mobility to

complete segmentation. Financial segmentation refers to the imperfect mobility

of financial capital between regional and national markets which arises

partly due to a less than competitive institutional structure of the local

banking industry. In a competitive financial market, a shortage of funds

will translate into higher regional interest rates than in the national

market, and thus attract national capital into the region and augment the

credit supply. However, in a less than competitive market fixed-price tends

to prevail via mechanisms such as price-leader. Fixed-price will result

in the allocation of funds via rationing in which the "implicit contract"

is struck between the lender and borrower to minimize the risk. The economically

stressed regions or a local market unfamiliar to investors at the national

financial market may be required to pay a location-related premium on top

of the regular interest charge to correct the investment risk associated

with the region. The fixed-price and implicit contract in less than competitive

markets may force down such location-related premiums, and thus discourage

financial flow from national to regional markets. The result is inadequate

supply of credit in a local area.

Corporate control structure of the financial industry may also affect

the regional money supply. (10) Entries by outsiders may change the market

structure of the financial industry in a region. In addition, the presence

of outsiders in a local market may exert pressures on the local institutions

to increase transparency in business dealings and become more competitive.

In discussing Asian financial problems, analysts have demonstrated a perplexing

contradiction concerning the merit of outside ownership in the financial

industry. On the one hand, many blamed foreign ownership as a culprit in

causing the sudden withdrawal of money from emerging economies that eventually

led to the financial crisis. On the other hand, prescribing remedies to

the problems in the financial sector of emerging economies, many analysts

have hailed foreign ownership in the banking sector as a way to increase

the competitiveness of a country's financial industry. Although these conflicting

arguments appeared since the Asian financial crisis, they are simply variants

of the same conflicting statements that have made their appearance in the

U.S. banking industry. There have been constant battles in U.S. banking

history between banks with various locational affiliations such as community

banks, regional banks, and banks with national dominance. The essence of

the battle is the claim to bank resources lying in a community. Before

banking deregulation, there had been a long tradition that saw bank ownership

in a local area by outside banks as a "bad" thing. The reason was that

outsiders would necessarily take local deposits and invest somewhere else,

which would drain resources out of a community and thus hurt its growth.

The agitation against branch banking and interstate banking, and strong

sentiment against large city banks were partly based on such an argument.

The recent two decades have seen a reversal of the tide in which banking

consolidation has swept the United States in the name of increasing local

market competitiveness as well as achieving economies of scale and scope.

However, old arguments die hard. Today, there are still concerns that non-local

banks may not be willing to lend to local establishments, especially small

businesses. The Community Reinvestment Act (1977 and revised in 1995) is

partly intended to make outside banks accountable for providing credit

to small businesses in the communities in which they operate. Clearly,

outsider ownership could be an evil when it is seen as the source of resource

drainage, or virtue when seen as a way to improve the competitiveness of

a local financial market. Since the logic could go either way, the impacts

of outside ownership largely become a matter of empirical evidence.

3. Study Area

In this study, all Kentucky counties are grouped into three categories.

The first is Appalachian, defined as rural counties that are designated

as Appalachian by the Appalachian Regional Commission (ARC). Metropolitan

areas that are designated as Appalachian by the ARC are not included in

this group. In 1997, there were 44 counties in this category. The second

group are rural non-Appalachian counties. There were 54 such counties in

1997. The third group consists of 22 metropolitan counties, including 17

non-Appalachian metropolitan counties, and 5 metropolitan counties designated

as Appalachian by ARC. In 1997, per capita incomes in all but two rural

Appalachian Kentucky counties were less than 70% of the U.S. average. In

comparison, only 2/5 of the non-Appalachian rural counties, and 4 out of

22 metropolitan counties, had a per capita income less than 70% of the

U.S. average. In 1996, the percent of people in poverty in Kentucky as

a whole was 17.9%. All rural Appalachian counties except one had a poverty

population higher than the state average, more than half of which were

higher than the state average plus one standard deviation. In comparison,

only a third of the rural non-Appalachian counties, and 2 out of 22 metropolitan

counties had a poverty population ratio higher than the state average.

Outside rural Appalachia, only one county had a poverty population ratio

higher than the state average plus one standard deviation. In 1996, the

unemployment rate in Kentucky Appalachia stood at 8.1%, while the corresponding

number for the U.S. was 5.4%, and for the Appalachia region as a whole

5.7%. In the same year, 15 rural non-metropolitan Kentucky Appalachian

counties had a 2-digit unemployment rate. All but 7 rural Kentucky Appalachian

counties are designated distressed counties by the ARC. In these distressed

counties, per capita income is no more than two-thirds of the national

average and poverty and unemployment rates are at least 150 percent of

the national rates. Things are not changing for the better for the region

while the American economic boom continues. In 1997, the mean unemployment

rate for Appalachian counties was 8.7%, in comparison with 6.1% and 4.7%

for rural non-Appalachian and metropolitan counties respectively. Apparently,

during the current national economic growth cycle, the longest during the

post war era, when many other regions in the nation face an increasing

demand for labor, Kentucky Appalachia as a whole still suffers from a slack

demand.

4. market Structure of Kentucky Depository Institutions

As of June 30, 1997, there were 459 depository institutions operating

in Kentucky. These firms operated 1667 offices and owned $48 billion in

deposits. A breakdown of these firms along the line of the type of institutions

and their distributions in the three regions defined above are presented

in Table 1. For the state as a whole, commercial banks are a dominant group

of depository institutions. The degree of dominance by commercial banks

appears more prominent when one examines the percent of number of institutions,

percent of number of offices, and the percent of deposits in sequence.

In comparison, thrifts and credit unions hold a significantly smaller share

of the market than commercial banks, and their share declines in a sequence

with the percent of number of institutions, percent of number of offices,

and the percent of deposits.

The patterns illustrated above generally hold for the three groups of

counties, but with important variations. Of the three groups of counties,

Appalachia demonstrates the highest degree of dominance by commercial banks

measured in all three percentages. In comparison, credit unions had an

extremely weak presence in Appalachia, especially as measured by the percent

of the amount of deposits. Metropolitan counties, on the other hand, has

the lowest representation by commercial banks of the three regions, measured

in all three percentages. In fact, their percentage in the number of commercial

banks is actually lower than that of credit unions. Rural non-Appalachian

counties as a whole attracted the largest number of institutions, mainly

commercial banks. Its share for different types of depository institutions

is similar to the state average, especially in terms of the percent of

deposits. A location quotient is constructed for the three groups of counties

via dividing the percent of deposits of a region by the state average,

Appalachia had a value of 1.05 for commercial banks, but a value less than

0.1 for credit unions. Metropolitan counties had a location quotient 1.2

for credit unions, but 0.97 for commercial banks. Both groups had a location

quotient 1.1 for thrifts. Rural non-Appalachia had a location quotient

close to 1 for all types of institutions.

Table 1

Kentucky Depository INSTITUTIONS

(percentage distribution in parentheses)

| Region |

Type of institutions |

# of operating institutions |

# of operating

offices |

Total deposits

($million) |

| All |

Total |

459 (100) |

1649 (100) |

48068 (100) |

| Kentucky |

Bank |

278 (61) |

1356 (82) |

41113 (86) |

|

Thrift |

46* (10) |

158 (10) |

4562 (9) |

|

Credit Union |

135 (29) |

135** (8) |

2393*** (5) |

| Rural |

Total |

99 (100) |

323 (100) |

7997 (100) |

| Appalachian |

Bank |

78 (79) |

282 (87) |

7180 (90) |

| Kentucky |

Thrift |

15 (15) |

35 (11) |

795 (10) |

|

Credit Union |

6 (6) |

6 (2) |

22 (****) |

| Rural Non- |

Total |

251(100) |

536 (100) |

13775 (100) |

| Appalachian |

Bank |

140 (73) |

454 (84) |

11868 (86) |

| Kentucky |

Thrift |

16 (8) |

46 (9) |

1208 (9) |

|

Credit Union |

36 (19) |

36 (7) |

699 (5) |

| Metropolitan |

Total |

195 (100) |

790 (100) |

26296 (100) |

| Kentucky |

Banks |

80 (41) |

620 (78) |

22064 (84) |

|

Thrifts |

22 (17) |

77 (10) |

2559 (10) |

|

Credit Unions |

93 (47) |

93 (12) |

1673 (6) |

* including savings banks and savings and loan associations

** each credit union is assumed to be operating in one office

*** includes deposits and shares in credit unions

**** less than 1%

Sources: National Information Center, Federal Reserve Board;

Credit

Union Data, National Credit Union Administration; Summary of Deposits,

FDIC. All data are for 1997.

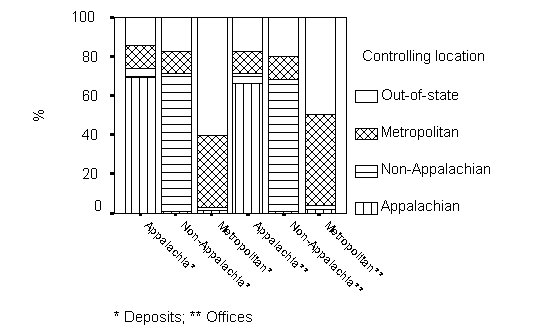

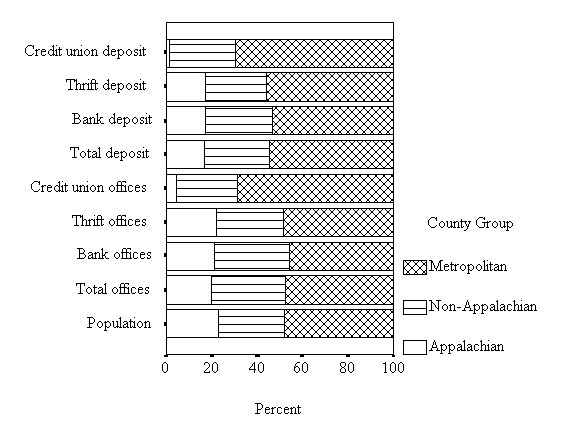

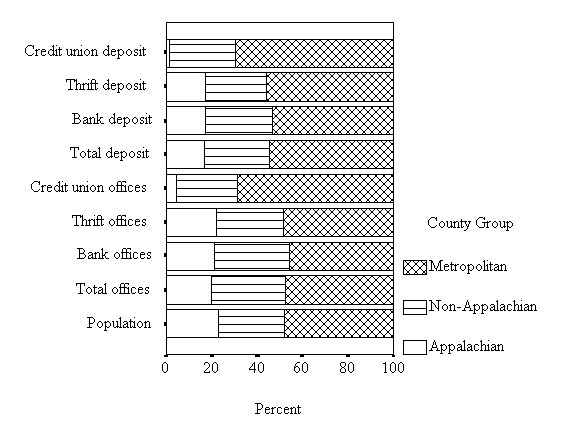

In 1997, Appalachia, rural non-Appalachia, and metropolitan counties

had 22.7%, 29%, and 48.3% of the Kentucky population, respectively. Using

the population share as a benchmark, the banking resource distribution

among the three groups of counties demonstrate uneven patterns. Appalachia

generally had a smaller share of banking resources than their population

share would indicate. However, the unevenness in the number of offices

is lower than that in the amount of deposits, as illustrated in Figure

1. This pattern exists for all three types of institutions. This indicates

that disadvantages in the Appalachian financial market lie more with insufficient

funds than with inconvenient banking locations.

Metropolitan counties contained a share of deposits larger than their

population share would indicate. However, the share of the number of offices

for metropolitan counties was similar to their population share, though

considerable variations exist among different types of offices. For thrifts,

there was a share higher than population share, and for credit unions,

there was a considerably higher share than the population share. These

higher shares, however, were mediated by a share lower than population

share in commercial bank offices. Apparently, the advantage of the financial

market in these counties are mainly reflected in ample funds available

rather than in convenient banking locations.

Rural non-Appalachian counties had a share of deposits similar to their

population share, especially in commercial banks and credit unions. However,

they had a share of offices larger than their population share, especially

for commercial banks. This suggests that rural non-Appalachian counties

as a whole do not face particular disadvantages in terms of the amount

of funds available. In addition, they have an advantage in terms of adequate

locations.

Figure 1

Regional Distribution of Kentucky Depository Institutions

For credit unions, the extreme contrast between Appalachian and metropolitan

counties is seen once again. Credit unions had an extremely strong presence

in metropolitan counties, but were conspicuously lacking in Appalachian

counties. This pattern can largely be explained by the close association

of credit unions with professional occupations and large organizations,

which would presumably be under-represented in Appalachia.

At the county level, the pattern revealed above basically holds. For

example, only 3 Appalachian counties had a deposit share larger than their

population share, and 12 had a share in the number of depository institutional

offices larger than their population shares. The number of rural non-Appalachian

counties with a share larger than their population share in the above two

categories were 18 and 39, respectively. This paper does not investigate

the pattern for the metropolitan counties since most metropolitan counties

in Kentucky form a metropolitan market with out-of-state counties, which

makes the comparison less meaningful.

An important measure of market structure is Hirfendal-Hirschman Index

or HHI, which is the sum of squared percent market share of all depository

institutions in an area. The higher the value of HHI, the more concentrated

the market is. The largest value possible is 10,000, which occurs when

there is only one firm in the market. In 1997, the mean HHI was 5352 for

all Appalachian counties, 3884 for all rural non-Appalachian counties,

and 2786 for all metropolitan counties. Figure 1 reveals a distinct concentration

of counties with a higher HHI in the Appalachian area, and a concentration

of counties with a lower HHI in metropolitan areas. It should be pointed

out that there are rural non-Appalachian counties that are highly concentrated

in terms of banking business. This, however, cannot conceal the fact that

for the region as a whole, Appalachia is more concentrated than the other

two regions. For example, there were 25 Appalachian counties with a HHI

higher than the state mean HHI, while there were only 17 in rural non-Appalachian

counties, and 2 in metropolitan counties. Of the 14 counties with a HHI

higher than 7000, a benchmark used by the Justice Department as high degree

of market concentration, 10 were in Appalachia.

Figure 2

Distribution of HHI in kentucky depository institutions (omitted)

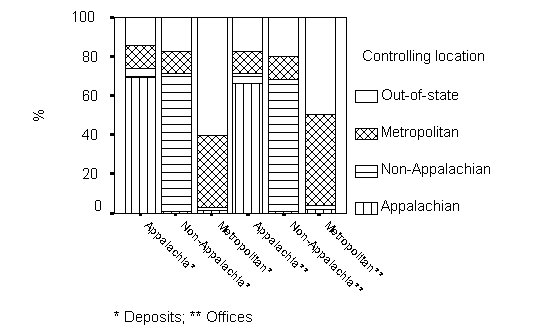

5. Control Pattern of Kentucky Depository Institutions

The 459 depository institutions operating in Kentucky in 1997 belonged

to 385 independent financial corporations. More than half of them, or 53%,

were independently owned institutions (banks, thrifts, and credit unions),

but controlled only 16% of deposits and 17% of offices. The rest 47% were

bank holding companies, which controlled 84% of deposits, and 83% of offices.

There were 22 out-of-state institutions controlling 40% the deposits and

34% of offices. Table 2 reveals how depository institutions headquartered

in one region distribute their business across the three regions in Kentucky.

As can be seen, depository institutions in each of the three groups of

Kentucky counties did most of their business within their own group, reflecting

the high percent of ownership in deposits and offices by a region's institutions

in its own region rather than in the other regions. However, compared with

institutions in Appalachia and rural non-Appalachia, metropolitan institutions

did more business outside metropolitan areas, especially in rural non-Appalachian

counties. Out-of-state institutions also seemed to favor metropolitan areas

as their business locations. Their percent ownership in deposits and offices

is significantly higher in metropolitan counties than that in Appalachian

and rural non-Appalachian counties. Interestingly enough, they allocated

proportions of their business in the three types of Kentucky counties similar

to those by Kentucky metropolitan institutions.

Figure 3 illustrates the controlling locations within the three types

of Kentucky counties. Appalachian counties was least influenced by out-of-state

institutions of all three types of counties. In addition, Appalachia as

a whole was less influenced by metropolitan institutions than rural non-Appalachian

counties. At the county level, a similar pattern can be seen. For example,

the average percent of deposits controlled by out-of-state institutions

was 11% for Appalachian counties, but 13% and 37% for rural non- Appalachian

and metropolitan counties respectively. In addition, the median percent

of deposits controlled by institutions outside a region --including institutions

both outside a region and outside Kentucky-- was 17% for Appalachian counties,

and 17% and 48% for rural non-Appalachian and metropolitan counties respectively.

Table 2

Control pattern of Kentucky Depository Institutions (Percentages in

Parentheses)

Controlled

in Controlled

in

Controlled by |

State of Kentucky |

Kentucky

Appalachia |

Kentucky

non-Appalachia |

Kentucky

Metropolitan

Areas |

| Kentucky

Appalachia |

6043/237*

(100/100) |

5565/215

(92/91) |

127/6

(2/3) |

351/16

(6/7) |

| Kentucky

non-Appalachian |

10481/394

(100/100) |

376/15

(4/4) |

9721/361

(93/92) |

384/18

(4/5) |

| Kentucky

Metropolitan Areas |

12160/465

(100/100) |

923/37

(6/8) |

1525/62

(13/13) |

9692/366

(80/79) |

| Out-of-state |

19384/553

(100/100) |

1114/56

(6/10) |

2402/107

(12/19) |

15868/350

(82/71) |

* amount of deposits in $million/number of offices

Sources: see Table 1

Figure 3

Regional Distribution of Institutional control

6. Summary and concluding remarks

This research finds that the depository institutions in Kentucky demonstrate

distinct regional patterns in market structure and in the structure of

corporate control. In terms of market structure, Appalachia counties in

Kentucky are the most concentrated, followed by rural non-Appalachian and

metropolitan counties. The disadvantage in Appalachian banking lies more

in insufficient funds than in banking locations. In contrast, the advantages

in metropolitan counties are in ample funds rather than in convenient locations.

In addition, rural non-Appalachian enjoy ample amount of funds as well

as convenient locations. In terms of the structure of corporate control,

Appalachian counties as a whole are least affected by outside institutions

including out-of-state institutions as well as metropolitan institutions.

Metropolitan markets are most influenced by out-of-state institutions.

Rural non-Appalachian counties are in an intermediate position. All these

observations suggest a more concentrated and closed financial market in

Appalachia than in the other two regions.

The above conclusions point to the direction for the next phase of investigation

that should focus on whether the growth problems in Appalachia relate to

their more concentrated and closed financial markets, as suggested by standard

macroeconomic theory. Specifically, the regional lending pattern should

be investigated in the context of market structure and the structure of

ownership. In addition, the regional growth pattern should be investigated

in the context of regional lending pattern as well as the regional market

and ownership structure. It may seem too early to offer policy implications

at this stage of the investigation. However, given the fact that most Asian

economies have finally started to turn around after significant financial

restructuring, among other changes, policies that are designed to strengthen

the financial market in Appalachia and make it more competitive and open

may be a positive step toward solving regional growth problems.

7. References

1. Amos, Jr. O.M. 1992. The Regional Distribution of Bank Closings in

the United States from 1982 to 1988. Southern Economic Journal 58

(3): 805-815.

2. Appalachian Regional Commission. 1997. 1997 Annual Report.

Washington, D.C.: Appalachian Regional Commission.

3. Bradshaw, M. 1992. The Appalachian Regional Commission: Twenty

-Five Years of Government Policy. Lexington KY: University of Kentucky

Press.

4. Harrigan, F.J. and P.G. McGregor. 1987. Interregional Arbitrage and

the Supply of Loanable Funds: A Model of Intermediate Financial Capital

Mobility. Journal of Regional Science 27(3):357-367.

5. Lord, J.D. 1992. Geographic deregulation of the U.S. Banking Industry

and Spatial Transfers of Corporate Control. Urban Geography, 13(1):25-48.

6. -----. 1990. Impact of Banking Acquisitions on Local market Concentration

in Florida. Southeastern Geographer, 30 (1): 1-16.

7. Miller, R.J. 1978. The Regional Impact of Monetary Policy in the

United States. Lexington MA: Lexington Books.

8. Raitz, K.B. and R. Ulack, 1984. Appalachia: A Regional Geography.

Boulder CO: Westview Press.

9. Rhoades, S.A. 1996. Bank Mergers and Industrywide Structure, 1980-1994.

Staff

Study 169. Washington D.C.: Board of Governors of the Federal Reserve

System.

10. Whalen, G. 1995. Out-of-State Holding Company Affiliation and Small

Business Lending. Economic & Policy Analysis Working Paper 95-4.

Washington D.C.: Comptroller of the Currency.

Controlled

in

Controlled

in